ISPO BEIJING 2017 – the most important sports-outdoor trade event on the Asian market – took place from 15 to 18 February in Beijing. The 14th edition of the trade show attracted to the Chinese capital a record number of 502 exhibitors, who presented products of 728 brands. Moreover, the organisers observed another rise in numbers of visitors – spacious interiors of the China Convention National Centre welcomed more than 40,000 guests. Once again ISPO BEIJING turned out to be a great venue to present the latest trends and innovations, and thanks to a rich programme of accompanying events, including numerous lectures, seminars and discussion panels, the fair was a great platform to gain knowledge about the Chinese market and, last but not least, it was a great opportunity for networking which is crucial on this constantly developing market.

China – Synonym for Future Market

There is no need to convince anyone that China is the global market of the future – this description became almost a synonym for Chinese prosperity. Dynamic economic development, which also affects significantly social relations in China, has become a constant characteristics of local reality. Although the Chinese economy has slowed down slightly, many branches of industry and services still continue to grow at a “two-digit” rate. From year to year, there are more members of the Chinese middle class who indulge in consumerism. A need to manifest one’s social status drives the domestic market – which is best observed in the luxury goods sector. Despite the fact that the insatiable economic growth has slightly decreased its dynamics in two recent years, China is still perceived by most brands as trading El Dorado.

Sports brands have already achieved a significant position on this market – products of adidas, Nike, Reebook may be found in most high street stores and shopping centres of Beijing, Shanghai or other big Chinese cities. The aspirational character of the offered goods is met in China with great demand and fulfils consumerist dreams of young Chinese customers. Sport lifestyle is only one side of the story – “fortunately”, the other key issue is the functionality of the majority of sports products.

As a proof for that may serve a recent boom in fitness and running industries. Many Chinese people have become very keen on running, especially those who are interested in active and healthy ways of spending their free time. However, it must be admitted that free time is a rare commodity (on average, a Chinese employee is entitled only to 5-10 days a year of paid holiday leave – source: Mercer).

Skiing Boom

Let’s go back to ISPO BEIJING and its accompanying exhibition ALPITEC CHINA. Taking into consideration the winter character of ISPO BEIJING, it should come as no surprise that the skiing industry was most exposed during sports presentations. As the organisers expected, the part of the trade show devoted to skiing facilities and equipment was an unquestionable success. ALPITEC CHINA enjoyed a great interest and, what was most important, became a place of intensive and substantial business talks.

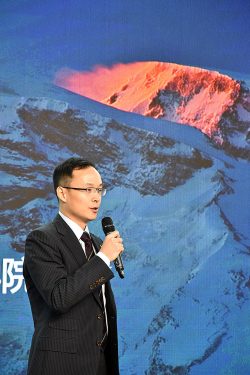

The reason for this seems clear – China is preparing to the Winter Olympic Games Beijing 2022. The arena for Olympic competitions will be skiing resorts – just one-hour ride from the capital by high-speed rail that is currently under construction. Presently, there are more than 500 skiing resorts and by 2022 additional 400 will have been built! Each of them is a fully equipped skiing resort with all necessary skiing facilities and appropriate accommodation. If we add that the Chinese authorities are planning to invest into winter sports billions of yuans, then the reasons for investment boom become clear. Beneficiaries of these investments will also be exhibitors at ALPITEC CHINA – ISPO BEIJING, among whom there were many companies from France, Switzerland and Italy.

It is a game with high stakes, which was additionally emphasised by a visit to the trade show of the French Minister of Sport. The exhibition of the “heavy” skiing facilities – snow guns, snow groomers, ski lifts and cable cars – was accompanied by business offers from companies specializing in design and construction of whole skiing resorts.

Tobias Gröber, Messe Muenchen, comments: “We have found out that winter sports have taken off in China. In our discussions with exhibitors at Alpitec China we heard mainly enthusiastic comments concerning surprisingly numerous orders – this proves that projects of developing skiing areas are actually being realized. One businessman from Whistler, USA, stressed that his company has collected so many orders that now they don’t really know how to deal with all of them…”

Nevertheless, skiing is a relatively new sport in China – it is estimated that currently there are “only” 10 million skiers in China. However, the market is growing by approximately 40% each year – the Chinese authorities want to achieve a goal of 300 million active skiers by 2026 (sic!).

The Asia Pacific Snow Conference 2017 attempted to discuss the complex picture of the current situation and future plans of the skiing industry. The conference, rich in varied business presentations, attracted around 400 participants. The room was full and the audience could listen to various presentations, including: A case study report White Book 2016, China Report on Ski Resorts Industry – prepared by Thaiwoo Ski Resort, China, and APPI Resort, Japan; a presentation focused on varying ranges of activities offered by resorts, including outdoor sports, in order to increase all-year interest in resorts; a lecture on creating a freeride community based on organisation of events and cooperation with resorts; an analysis of a successful development of a skiing resort YongPyong, South Korea – which will hold next year’s Winter Olympic Games. The whole conference finished with a discussion panel concerning new solutions for Chinese skiing resorts.

Outdoor Industry Needs More Patience

While skiing industry seems to have the glorious future awaiting, outdoor business appears to have lost its breath. After 10 years of dynamic growth, time has come for a market correction. This market sector is maturing, which poses much bigger challenges and demands for players. Clearly, time of two-digit growths has come to an end.

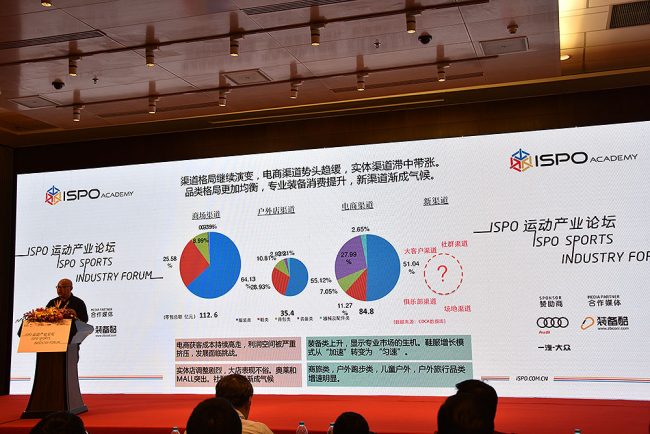

The results of this year’s COCA (China Outdoor Commerce Alliance) Report, which were revealed during ISPO BEIJING 2017 (or more precisely at the conference ISPO Sports Industry Forum) brought us the news that the wholesale results for 2016 increased by “only” 6.53% – which translates into 13.11 billion RMB (€1.79 billion). Even lower growth was observed in retail sales for 2016 – 4.91%, which equals 23.38 billion RMB (€3.19 billion).

The presentation of an annual report by the China Outdoor Commerce Alliance (COCA) – fot. 4outdoor.pl

These were not the only symptoms of the “cooling-down” trend – also specialist shops are experiencing difficulties. Some of them were even forced to close down. Others, especially smaller ones, are struggling with growing prices of rents. Bigger players are also facing challenges – recently, competition has significantly increased, customers’ demands grow higher, and there is a strong pressure from e-commerce distribution channels.

At the conference, a few life-saving solutions were suggested – including better customer service, development of product ranges (inclusion of the lifestyle segment) and avoidance of price wars, which bring only short-term results. The long-term objectives included expansion of the outdoor market by gaining new customers and constant popularisation of outdoor activities among members of the society.

The Chinese outdoor market has reached a certain saturation moment. Ron Lightfoot, Sea to Summit, and Ian Steinmo, Camelbak, describe it as a specific correction of the industry, which was developing very dynamically in previous years. According to them, this change is also visible at the trade show. Until recently, ISPO BEIJING was a place where the majority of visitors could get acquainted with new products and this fascination with the new was often turned into opening their own outdoor shop. Now the situation has changed – many retailers visit trade shows in Europe, while the Beijing fair mainly acts as an opportunity to sustain business contacts. It is worth noting how the market is seen by one of the biggest players – Tutwo, a company that owns more than 1,200 outdoor shops. The company, founded in 2006, operates as well in the Internet using three of the most popular Chinese trading platforms (including jd.com and Tmall.com).

What is interesting, online sales levels in case of Tutwo are not that high. According to Cony Yutingtao, Vice President of the Products Department at Tutwo, online sales oscillate around 6-8%. Currently, the company focuses on retailing through brick-and-mortar shops – they continue to open new stores. It should come as no surprise since annual growths reach 30%! As Yutingtao emphasises, e-commerce is clearly one of the most importance trends and Tutwo is also going to develop in this direction.

Tutwo does not only mean B2C sales – in its distribution portfolio the company has several outdoor brands including Salewa. At ISPO BEIJING 2017 Tutwo exhibited on a huge joint-stand together with the company from South Tirol. Within B2B channel Tutwo co-operates with approximately 1,000 shops.

When asked about the greatest competitors, Yutingtao mentiones Decathlon, which at present has a chain of 200 shops in China and is planning to open a few hundred more within next 5 years…

In case of domestic competitors, the situation is different because they – unlike Tutwo – do not operate on the scale of the whole country. The majority of Tutwo’s competitors limit themselves to major cities. For Tutwo the most important region when taking sales into consideration are the north-east and east areas of China, which is mainly caused by local climate characterised by 7-8 cold months a year.

When talking about current market situation, Cony Yutingtao remarks: “Many players on the outdoor market have observed falls in sales, which is an contrasting trend when compared to the whole Chinese market and its constant growth. Retail competition on this specialized market has got tougher, even though people have more free time, they think about consumption and enjoying life and at weekends they escape from the city to engage in outdoor activities. I estimate that there are more than 900 brands on the market – which is divided 50/50 between domestic and foreign brands. That’s why currently the market situation is tough. Nevertheless, the future seems to be bright.”

Other significant specialist outdoor distributors that could be encountered in Beijing included Himalaya and Blu Ice Adventure. Himalaya focuses mainly on specialist outdoor and running brands. The company’s portfolio includes above 20 brands. As we were assured by Kai Zhao, Vice President of Himalaya, the company’s philosophy is defined by technical brands, such as Black Diamond, Outdoor Research, Vasque, Zamberlan, Thermarest, and also running/athletic brands like Nathan and Pro-Tec. Himalaya, which has operated for 15 years, co-operates with approximately 400 retailers.

Kai Zhao points out that there is a steady growth of interest in climbing – the company has significantly contributed to popularisation of climbing by co-organization of various events, e.g. the China Trad Festival. According to Zhao, there are still not many climbers in China – this number is estimated not to exceed 100,000. Nevertheless, this activity is gaining on popularity and consequently demands for quality and functionality of climbing gear are also increasing.

Blue Ice Adventure is a distributor with a slightly less specialized portfolio, which includes such brands as Crispi, Dynafit and Aku. One of important elements of the company’s strategy is Kuhl. This is a response to new demands from the market, which is to some extend distancing itself from the core outdoor and heading towards products which successfully combine functional materials with lifestyle chic.

This transformation is stressed by Joe Langwald: “We are trying to focus on the outdoor-lifestyle segment. Until recently those two segments were separated but now we have many crossover products. As a good example may serve Kuhl trousers, which may be used for a mountain excursion and later on the same day they will look great at a restaurant in the evening.”

The company went to ISPO BEIJING looking for a business partner producing high-quality backpacks – in this way they wanted to complete their product offer and achieve a full portfolio, which is a common practice among Chinese distributors who respond in this way to requirements of multibrand retailers. Joe Langwald explains: “We are observing a lower interest in monobrand shops in shopping centres. Currently, there are more big-surface stores being created in shopping centres, in which customers may buy various products of various brands.” Blue Ice Adventure co-operate with around 100 shops and retail points.

Online they sell products of Crispi and Aku. Dynafit is still waiting for a suitable partner. The company is planning to manage online sales of Kuhl by itself, though customers still have to get better acquainted with products of this brand which is relatively new in China.

As Joe adds: “On the Chinese market, unlike in Europe, it is difficult to operate independently with your own shop – the market is dominated by big players, such as jd.com, t-mall.com, taobao.com. Each of these platforms specializes in a certain market segment – fashion, electronics, etc. It is important to find a suitable partner for one’s unique brands.”

When asked about the changing Chinese market, Joe answers: “I moved to China in 2002 but only a few years ago I got involved in outdoor business. Initially, I distributed Icebreaker all by myself. Two and a half years ago I started with Kuhl. Recently, I have joined forces with Jeff White and his company. The market is changing dramatically and sometimes I regret not starting 15 years ago – like Jeff. Then you could trade anything without any difficulties – money was flooding and companies used to develop at a staggering rate. Now the Chinese economy is not as strong as it used to be a few years ago. There are various problems. Yet the market keeps growing and it has a great potential. However, nowadays a success requires more time and work.”

Foreign Brands on Chinese Market

Visitors could see in Beijing booths of such brands as Millet, Scarpa, Fjällräven and Hanwag – represented by their Chinese branches. Many other brands were represented by their Chinese distributors – some of them have already been mentioned in this article. It is worth paying attention to an important role played at ISPO BEIJING 2017 by brands such as: Lowa, Leki, Meindl, Vaude, Asolo, Keen, Gregory, Garmont, Alpine Pro or Thule.

Huge brands as The North Face, Columbia and Patagonia may be seen as tycoons of the Chinese market. However, those players did not exhibit at ISPO BEIJING 2017. Numbers of monobrand shops – and each of those brands has at least a few hundred of them – suggest that their strategy is about focus on the end-consumer. Interesting seem experiences of specialist brands, like Millet and Scarpa, who started their adventure with the Chinese market quite recently (respectively 6 and 4 years ago). Last year, Millet opened its Chinese branch which co-operates now with 15 big retailers, including Sanfo shopping chain.

History of Scarpa on the Chinese market was summarised by Joe Chen, the company’s Brand Manager: “4 years ago we formed the Chinese branch of Scarpa. Since then we have noted two-digit growths. In 2016, as compared to 2015, we had a 25-30% increase in sales. Also our distribution network is growing. We operate through 3 main channels: specialist stores, shops-in-shops at malls and our own online shop based on the Tmall platform. We have been selling our products online for a year and a half and I can say that we’ve double our sales over this period. We are very satisfied, especially since we entered the market quite late. We sell high-tech products and there is a growing customer group for this kind of products in China. I may add that another important segment of our offer are lifestyle products – on such a polarised market each player has to carefully look after their target customers. Scarpa products are sold in approximately 100 shops and our key business partner is the Sanfo chain. Currently, it seems that number one on the market is Lowa, also Crispi is doing fine – those are our main competitors and we would like to catch up with.”

Czech Case Study

It might be interesting to analyse activities of a Czech skiing-outdoor brand – Alpine Pro. This Czech company clearly marked its presence at ISPO BEIJING 2017 – not only with a big booth, but also by dressing the whole ISPO team in Alpine Pro jackets, which were additionally decorated with an interesting visual motive inspired by traditional Chinese art.

Alpine Pro has been present on the Chinese market since 2009. During those years, the company mainly focused on selling skiing apparel. Last year, Alpine Pro initiated a co-operation with Goldman Hontion regarding distribution of their outdoor segment.

Tomas Tauchman from Alpine Pro relates his Chinese experience: “In Czechia we are the major skiing brand but our offer also includes outdoor apparel and backpacks. However, in China we focused on skiing segment because we knew that in other sectors we were not competitive. Up to 2016 we did everything by ourselves – we invested into creating a branch of our company in China. We we were not looking for a partner or agent. We were one of few multinational companies that chose such a strategy. Last year we made a decision to share our workload with a partner – we signed an agreement with Goldman Hointion, a company with extensive experience in managing brands. As a result, Goldman Hointion gained exclusive rights to the majority of our assortment – though sales of the skiing collection still remain in our hands. The skiing market is still quite small – we co-operate mainly with shops located in skiing resorts. However, this is a very prospective segment of the market in a 10-20 year perspective. We’d like to further develop this channel of distribution. So far we have around 700 retail points – majority of which are connected with sales of our outdoor collection, while about 50 sell skiing clothes. We are also planning to open monobrand shops in big shopping centres.”

Alpine Pro started its Chinese adventure with exhibiting at ISPO BEIJING 2009. Tomas stresses that the fair acts as an important business platform for outdoor industry, but in case of the skiing segment it is the most important event in China. Only here one may meet managers of skiing resorts, owners of skiing schools and opinion leaders of the skiing industry.

And finally he remarks: “In Europe skiing is a part of local culture, lifestyle and sport. In China people have just started to discover it. Now it is a trend – many people want to try it but only for few it is an actual sport. It is still unknown how many of them are willing to associate with skiing for a longer period of time. However, there is a big chance that with the governmental support popularity of skiing is about to rise significantly. At present, it is difficult to assess accurately this what’s happening on the market.”

Also other exhibitors from the Czech Republic were visible in Beijing – they exhibited at ISPO BEIJING within a joint national pavilion. The exhibition of the national Czech brands, like Directalpine, Rock Empire, Singing Rock and Tendon (Lanex), was supported by Škoda and organized by the Czech Trade government agency.

Ondrej Neuman at Directalpine reflected on his visit in Beijing: “This is our second time in Beijing. The previous edition of the fair was a success for us so we decided to return to the event. Last year, we gained some good contacts – including a new co-operation on Taiwan. It was also a good opportunity to learn about the market. Now we are better prepared – before the trade fair we analysed our contact lists, we sent offers (our catalogues were also available in a Chinese version, because the majority of local entrepreneurs do not speak English) and now we are hoping to make the next step.”

The specific character of the market calls for specific actions, adds Ondrej: “What is important, we’ve selected from our collections a group of products which we want to present here. We concentrate on our best products in order to distinguish ourselves in the sea of goods available in China.”

On the other hand, the representative of Directalpine describes their fair activities in the following words: “We have several meetings arranged with serious potential partners – this is the effect of our thorough preparations. Currently, we are also present in South Korea and Japan – these markets turned out to be good for us, we’ve observed growths. Therefore, I’m convinced that also in China we may count on new clients – we only have to find suitable distributors or agents. So far we haven’t made any formal preparations to doing business here, we are only exhibiting at the fair, presenting our offer – we’ll see what comes out of it.”

When asked about his evaluation of the fair meetings, he added: “I must admit that I’ve noticed a difference between events in Munich or Friedrichshafen and the Beijing fair. In Europe, the majority of visitors come from the B2B sector, while at ISPO BEIJING we encounter many end-customers because this fair is open to them as well. This is a new challenge for us because part of the time we need to devote to talks that are not very business related. Although it might be annoying at times, it provides us with a lot of information about Chinese customers.”

Many companies might be interested to know if exhibiting in “national pavilions” makes any sense? Ondrej explains: “Yes, it seems that our visitors know Czech products and they are aware that our goods represent European quality. We may say that they have German quality at a lower price. So presenting a bigger number of brands combined together makes sense – especially if all these brands have a common characteristic – high quality at a competitive price. This type of synergy has a positive effect. In our case there is also the issue of support by the Czech Trade, which aids construction of joint national booths and provides assistance in participation at international fairs.”

Chinese Brands – Toread and Kailas as Leaders

Of course also Chinese domestic brands were present at ISPO BEIJING 2017. Presence of such players as Toread, Kailas, Pelliot, Arctos (former Shehe), Carava or King Camp was strongly marked during the fair. The leader on the Chinese outdoor market is Toread – a company with a wide range of products from specialist to casual. The popularity of this brand is very visible on Beijing streets – Toread logo constantly appears on jackets of passers-by.

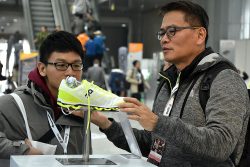

When we take into consideration more specialized outdoor/climbing gear and apparel, then the unquestionable market leader is Kailas. This dominance was also apparent at the trade fair. The spacious booth of Kailas was very lively – full of interesting products, film shows and presentations. On all fair days it attracted many visitors. Kailas does not limit itself only to the domestic market (the brand sells its products in more than 500 shops in China, including more than 100 monobrand stores) – now it is trying to expand to Europe and the USA by sponsoring climbing competitions (also those organised by IFSC) and film festivals (e.g. Kendal Mountain Festival).

In the words of a Kailas representative: “The Chinese climbing community is still small. Despite the fact that there are still only few climbers in China, we are trying to produce technologically advanced gear – like the ice axes, harnesses, helmets, quickdraws, ropes, etc. that we exhibited at the fair. I must add that at ISPO BEIJING 2017 we are presenting only a selected part of our wider offer – we’ve decided to focus on rock climbing and mountaineering products. And what is important, many of these products have been awarded in Munich and Friedrichshafen.”

The company that is the owner of Kailas also has in its portfolio brands such as Vaude and Meindl, which were presented at a neighbouring booth.

The development of domestic brands is also confirmed by companies supplying them with high-quality materials – like Gore or Primaloft. Gore returned to the Beijing fair with its own booth. It was one of the most popular places of the event. The booth attracted visitors not only with visual arrangements but it also organised a presentation of Sun Bin, who hosted one of the most popular actors in China.

Sun Bin, who owns a mountain tourism agency and has sat on several ISPO AWARD juries, related during his presentation his recent trip to Kilimanjaro – he took with him also his famous guest. As the result we could listen to an interesting story which successfully promoted mountaineering and outdoor in the Chinese society. It was easy to guess that the guest was a celebrity because of a great commotion on the Gore stand and the numbers of bodyguards and journalists.

Jochen Lagemann, Primaloft, confirms the growing role of the domestic market in China – more local brands have started appearing and more of them have started using high-class materials. It is safe to assume that soon Chinese companies will start their global expansion. It is visible that young brands can grow into big companies within 2-3 years, which is a clear sign of serious financial investments. Many local brands sell their products in own brand shops or via shop-in-shop systems.

Jochen is another person who tells us that e-commerce is a dominant and still growing channel of distribution in China – he adds jokingly that Europe when compared to China is still in the “stone age”. Another interesting aspect according to Jochen is a new shift in the range of offered products. Not so long ago outdoor collections dominated the market, yet currently we witness a new approach – a growing number of offers are dedicated to lifestyle and urban collections. Due to obvious reasons, the skiing apparel segment is undergoing an intensive development.

3rd China Rock Climbing Summit

Despite being young and relatively small, Chinese outdoor is a dynamically developing market sector. If that is the case, then what can be said about “a niche within a niche”, as we may call the Chinese climbing scene? One thing is certain – there are ample amounts of climbing enthusiasts in China. Although there are no precise reports estimating numbers of local climbers, one may assume that we are dealing with an amount not exceeding 100,000 active climbers.

On the other hand, it is worth paying attention to enthusiasm and passion characterising the Chinese climbing community. The mere fact that the 3rd edition of the China Rock Climbing Summit took place during ISPO BEIJING 2017 clearly demonstrates that climbing activists are very engaged in the sport.

One of the best-informed people is Liza Di Liu, editor of the Chinese version of the popular 8a.nu website. Apart from her journalistic work, Liza engages into various projects popularising climbing among children. She estimates the numbers of climbers in China in the following way: “It’s believed that there are around 50,000 climbers in China. If we narrow this amount only to true enthusiasts, who devote at least 1-2 days every week to climbing and training, then the number drops to approximately 10,000.” Then she adds: “Climbing in China is at the very beginning of its path – we’re trying to create a climbing community and culture by organising events focused around safety in climbing (on which topic I’ve also given a lecture at the fair). However, it is not easy to build climbing awareness – recently 4 climbing magazines have been closed down so we’re trying to reach climbers through social networks.”

Most climbers in the world are familiar with such well-known sites as Yangshoo or Getu. These climbing areas have been popularised by climbing events (e.g. Rock Petzl Trip in Getu), and now are flagship crags of the Chinese climbing. However, climbing potential is really huge. Undoubtedly, new areas will be gradually discovered and developed while climbing will keep growing in China for years. It must be admitted that Chinese climbing, similarly to the whole outdoor sector, has been experiencing a slight stagnation. Many owners of climbing centres complain about lack of customers, some climbing walls have been closed. As salvation might be seen climbing coaching and popularisation of climbing among the youngest.

This opinion has been confirmed by Liz Di Liu: “I’m most concerned about those who have invested their own money into climbing walls and managed them with passion and devotion. Unfortunately, now this business has become very demanding – many operators don’t have funds left to keep investing into not fully profitable businesses. This is a particularly difficult period for climbing walls. If they survive, that will be only because they’ve associated their future with coaching children and teenagers. If climbing centres focus on youngsters, it will be their only chance to continue developing climbing and promoting outdoor. Support for training kids comes from outdoor companies and state institutions.”

Another important factor in popularising climbing and integrating the climbing community are climbing festivals in Yangshuo and Getu. These events were described during a conference by their organisers. Additionally, during the China Rock Climbing Summit there were extra workshops on running a climbing centre and issues connected with climbing safety.

Very popular are also climbing competitions – this year there were above 25 various events from National Championships, through purely social events and up to the World Cup competitions. Majority of events are bouldering competitions because there is a shortage of climbing walls adapted for lead competitions.

Another guest of the conference, Urs Stroecker, President of the UIAA Ice Climbing Commission, wondered about ways of increasing attractiveness of ice climbing competitions in China. What is important this type of climbing still has a chance to be included the Olimpic Games – similarly to sport climbing. The first step in this direction will be made next year in Pyongchang where ice climbing will be featured as a demonstration sport. Ideally, the final stage would be including ice climbing in Olympic disciplines at the Beijing Olympics 2022.

***

When I landed in Beijing I came across the latest issue of “China Daily” when I found a huge front page article on the brainchild of the Chinese industry – C919. This enigmatic codename was given to an innovative passenger plane designed and built by COMAC company from Shanghai. By the end of the previous year COMAC received more than 570 orders for this new machine. Time will tell if China becomes an airline superpower but C919’s success indicates the dynamics of growth of the Chinese economy powered by the domestic consumption.

Although sports market is governed by slightly different rules, also there a big economic revival has been observed for the last couple of years. The middle class, which is growing and constantly getting more affluent, has become a driving force for sports and outdoor industries. The Winter Olympics Beijing 2022 is another reason for a boom in the sector of winter sports, especially in the case of skiing resort facilities. On the other hand, outdoor industry has matured – now the challenges it faces are much more demanding and require a better knowledge of the market and business tools.

Thereby, a platform is needed for gaining new clients, exchanging knowledge and experience and for networking – fortunately, ISPO BEIJING played this role excellently for the 14th time.

Piotr Turkot

PS Next ISPO in China – ISPO SHANGHAI 6-8 lipca 2017. Last year summary you can read here: ISPO SHANGHAI 2016, How to Conquer the Market of the Future.

ISPO BEIJING 2017 photo gallery:

- Konferencja prasowa otwierająca ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Ekspozycja ISPO AWARD podczas ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Klaus Ditttrich z Messe Muenchen otwiera targi ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Prezentacja wyników corocznego raportu China Outdoor Commerce Alliance (COCA) – fot. 4outdoor.pl

- Sea to Summit (fot. 4outdoo.pl)

- Stoisko CamelBak (fot. 4outdoor.pl)

- Stoisko dystrybutora Himalaya (fot. 4outdoor.pl)

- Prelekcja Jona Otto na stoisku Kailas (fot. 4outdoor.pl)

- Tomas Tauchman z Alpine Pro (fot. 4outdoor.pl)

- Pokaźne portfolio Tutwo (fot. 4outdoor.pl)

- Prelekcja Jona Otto na stoisku Kailas (fot. 4outdoor.pl)

- Stoisko Thule (fot. 4outdoor.pl)

- Jedna z prezentacji ISPO BEIJING 2017 (fot. 4outdoor.pl)

- ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Joe Chen z chińskiego odziału Scarpa (fot. 4outdoor.pl)

- Stoisko Primaloft (fot. 4outdoor.pl)

- Jedna z prezentacji ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Atrakcje ALPITEC CHINA 2017 (fot. 4outdoor.pl)

- Pawilon kanadyjski (fot. 4outdoor.pl)

- Stoisko Kailas (fot. 4outdoor.pl)

- Sprzęt wspinaczkowy na stoisku Kailas (fot. 4outdoor.pl)

- Stoisko Kailas (fot. 4outdoor.pl)

- Stoisko Kailas (fot. 4outdoor.pl)

- Cieszące się dużą popularnością stoisko Kailas (fot. 4outdoor.pl)

- Stoisko Kailas (fot. 4outdoor.pl)

- Joe Langwald z Blue Ice Adventure (fot. 4outdoor.pl)

- Jeff White (po lewej) z Blue Ice Adventure (fot. 4outdoor.pl)

- Ceremonia wręczenia nagród ISPO AWARD dla marek pochodzących z Dalekiego Wschodu (fot. 4outdoor.pl)

- Ceremonia wręczenia nagród ISPO AWARD dla marek pochodzących z Dalekiego Wschodu (fot. 4outdoor.pl)

- Atrakcje ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Atrakcje ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Spotkanie z celebrytą na stoisko Gore (fot. 4outdoor.pl)

- Spotkanie z celebrytą na stoisko Gore (fot. 4outdoor.pl)

- Spotkanie z celebrytą na stoisko Gore (fot. 4outdoor.pl)

- Ondrej Neuman z Directalpine (fot. 4outdoor.pl)

- Stoisko – marka puchowa – ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Asia Pacific Snow Conference 2017 (fot. 4outdoor.pl)

- Asia Pacific Snow Conference 2017 (fot. 4outdoor.pl)

- Asia Pacific Snow Conference 2017 (fot. 4outdoor.pl)

- Stoisko Alpine Pro (fot. 4outdoor.pl)

- Jedna z ekspozycji ALPITEC CHINA 2017 (fot. 4outdoor.pl)

- Jedna z ekspozycji ALPITEC CHINA 2017 (fot. 4outdoor.pl)

- Stoisko Fenix Group (fot. 4outdoor.pl)

- Tobias Grober z Messe Muenchen (fot. 4outdoor.pl)

- Jedna z prelekcji 3. China Rock Climbing Summit w ramach ISPO ACADEMY (fot. 4outdoor.pl)

- ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Stoisko Pelliot fot. 4outdoor.pl)

- Stoisko Mobi Garden ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Kai Zhao – vice president Himalaya (fot. 4outdoor.pl)

- ISPO BEIJING 2017 (fot. 4outdoor.pl)

- ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Stoisko KingCamp (fot. 4outdoor.pl)

- Stoisko Mobi Garden ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Produkty z ISPO AWARD cieszyły się dużym zainteresowaniem (fot. 4outdoor.pl)

- China Convention National Center

- China Rock Climbing Summit – ISPO ACADEMY, ISPO BEIJING 2017 (fot. 4outdoor.pl)

- China Rock Climbing Summit – ISPO ACADEMY, ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Prezentacja ISPO AWARD – ISPO BEIJING 2017 (fot. 4outdoor.pl)

- China Rock Climbing Summit – ISPO ACADEMY, ISPO BEIJING 2017 (fot. 4outdoor.pl)

- ISPO BEIJING 2017 (fot. 4outdoor.pl)

- Konferencja prasowa ISPO BEIJING 2017, 14 luty (fot. 4outdoor.pl)

- ISPO BEIJING 2016 (fot. Messe Muenchen)

- ISPO BEIJING 2016 (fot. Messe Muenchen)

- ISPO BEIJING 2016 (fot. Messe Muenchen)

KOMENTARZE